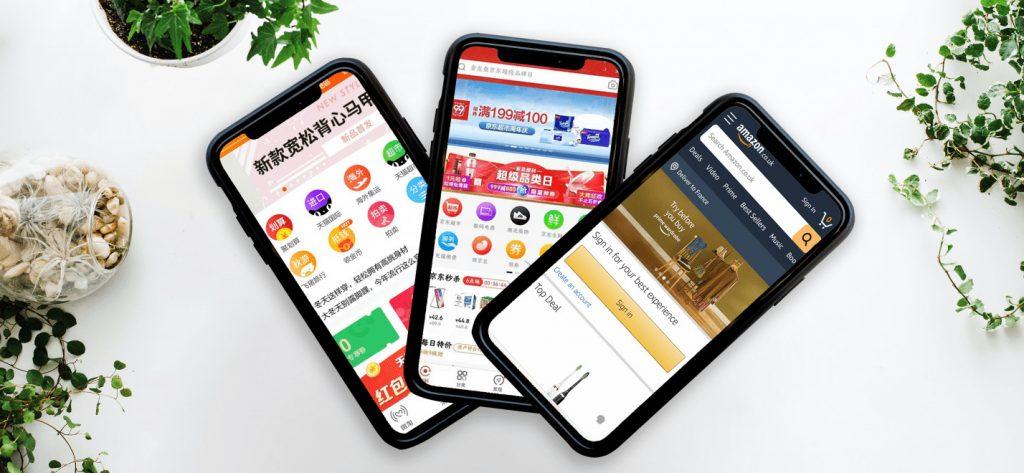

Sorry Amazon, but things work differently in China

Rivaled by Alibaba and JD.com, the American giant closed its marketplace amazon.cn in 2019.

Faced with local competition, Jeff Bezos is merely one entrepreneur among many others, who have experienced that the omnipotence of some Western companies could be in vain in China.

It is only in recent years that we have started to talk about the rivalry between BATX (Baidu, Alibaba, Tencent, Xiaomi or rather Huawei) and GAFAM. However, few of these Western giants have successfully established themselves in the Chinese market. Although the Chinese market presents great potential for Western companies, it is time to ask whether there are any pitfalls that need to be avoided in this territory.

Getting started in China? Be careful, but don’t fall behind!

Amazon came in well after the two big local players, Alibaba and JD.com. The latter launched their marketplaces respectively in 2003 and 2004. At the time when the two Chinese platforms reinforced their own community, Amazon had just set foot on Chinese territory in 2004. With a view to a quick start, Amazon bought the Chinese website Joyo.com for $75 million, which was, however, quickly eclipsed by its local competitors. And it took Amazon until 2011 to finally rename the site as Amazon China.

In a fast-growing country, reactivity matters!

The development of e-commerce and marketplaces has also accelerated the evolution of logistics systems in China. Chinese brands very quickly developed efficient networks, either with external partners or with internal solutions. While Alibaba and JD.com are committed to delivering their orders by express, even to the most isolated regions in China, Amazon obviously failed to meet this challenge. Most deliveries are offered for free by Alibaba’s Taobao. JD.com with more than 700 warehouses across China offers delivery within 24 hours for cities and 48 hours maximum for remote areas. Amazon, on the other hand, offered standard free shipping only to orders for more than 200 yuan (€26.5).

Aware of its inefficient and utterly expensive delivery service compared to the rivals, Amazon decided in 2015 to open an online store on Tmall, one of Alibaba’s marketplaces. Indeed, since Alibaba blocks the indexing of its pages on Baidu (the main search engine in China) in order to encourage consumers to use its own search engine, this was most certainly not a desired decision. It probably damaged its brand image, but with Google unavailable in China, Amazon had no other options to acquire traffic on its platform.

Can Alibaba Actually Kill Amazon?

To be successful internationally, you must adapt to local conditions or have the means to impose yourself globally, like Airbnb or Coca-Cola! A successful business model in the United States or in Europe does not necessarily work in China. Likewise, a business model that works in China is not necessarily viable in Europe or the United States, either! Despite its similar evolution to Airbnb or Coca-Cola, can Alibaba really kill Amazon with its unique business model?